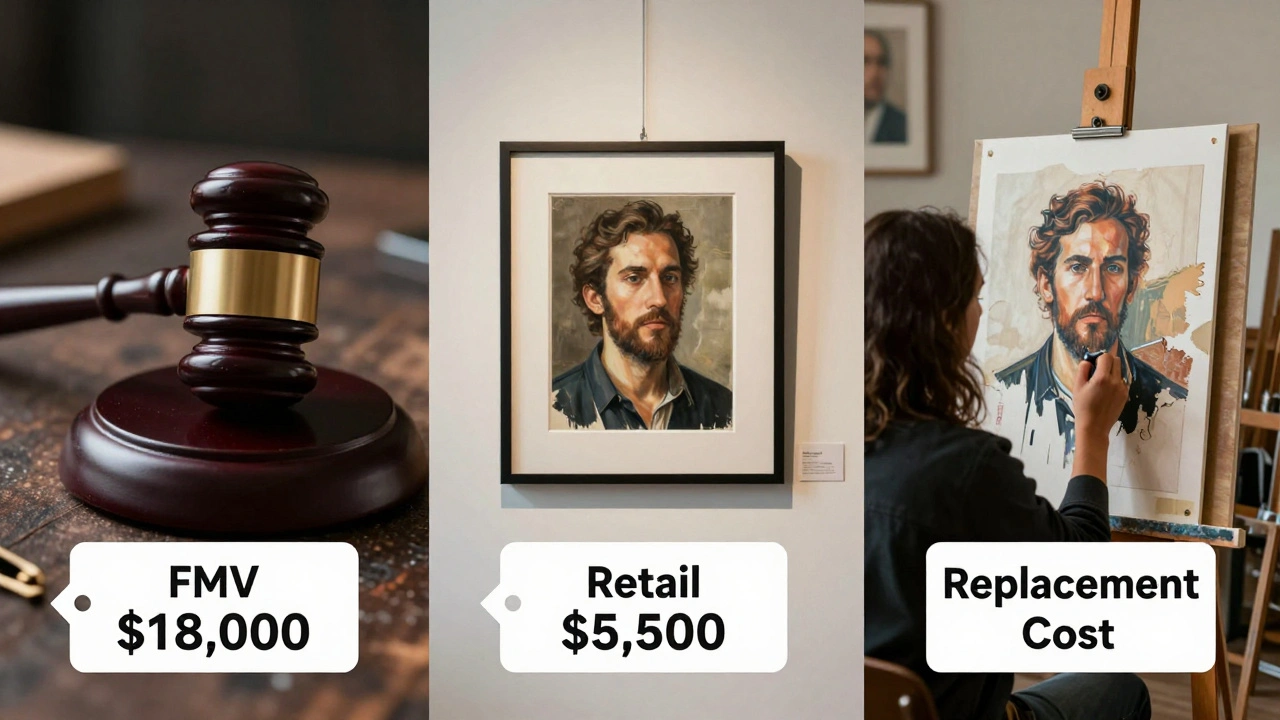

Valuation Methods for Art Insurance: FMV, Retail, Replacement

When you own a piece of art-whether it’s a $500 painting from a local artist or a $2 million Picasso-insurance isn’t just about peace of mind. It’s about getting the right amount of money back if something goes wrong. But here’s the problem: not all art valuations are the same. Insurance companies don’t just look at what you paid. They use three main methods to decide how much to pay out: FMV, retail value, and replacement cost. Knowing the difference can mean the difference between a fair payout and a fight with your insurer.

What Is FMV in Art Insurance?

FMV stands for Fair Market Value. It’s the price a willing buyer and a willing seller would agree on in an open market, with both parties having reasonable knowledge of the artwork and no pressure to buy or sell. This is the most common method insurers use because it’s based on actual sales, not guesswork.

For example, if you bought a 1972 Joan Miró lithograph for $15,000 in 2018, and it sold at auction for $18,000 last year, that $18,000 is your FMV. Insurers rely on auction records, gallery sales, and appraisals from certified art professionals to determine this. They won’t use what you paid-unless it’s recent and matches current market trends.

But FMV has limits. If your artwork is rare, or if there haven’t been any recent sales of similar pieces, FMV can be hard to pin down. That’s why some policies don’t use FMV alone. It’s also not always the best option if you need to replace the piece.

Retail Value: The Gallery Price Tag

Retail value is what a gallery or dealer would charge to sell the artwork to a customer. It’s usually higher than FMV because it includes the dealer’s overhead: framing, marketing, storage, insurance, and profit margin. For emerging artists or pieces sold through galleries, retail value is often the most accurate reflection of what it would cost to buy a similar piece today.

Let’s say you own a limited-edition print by a rising contemporary artist. You bought it for $3,000 from a small gallery. Today, the same gallery lists it at $5,500. That $5,500 is the retail value. If your art is damaged and you need to replace it, this number gives you a clearer picture of what you’d actually have to pay to get something comparable.

But here’s the catch: retail value isn’t always stable. If the artist’s popularity drops, the gallery price might fall. Or if the gallery closes, you lose that pricing reference. That’s why insurers often require a recent appraisal-usually within the last two years-to confirm retail value claims.

Replacement Cost: What It Really Means

Replacement cost is the amount it would take to buy a new piece that matches the original in quality, size, style, and artist. This is the most generous option for policyholders-but also the most expensive for insurers. It’s not about what the original sold for. It’s about replacing it with something equivalent, even if that means commissioning a new work.

Imagine you own a custom portrait painted by a well-known artist in 2020. The artist is now retired, and no more originals exist. You can’t buy another one. But if you have a replacement cost policy, your insurer may pay to commission a similar portrait from another artist of comparable skill and reputation. Or they might cover the cost of acquiring another original from the same period and style-even if it costs $20,000, while your FMV was only $12,000.

Replacement cost policies are rare in art insurance. They’re usually only offered for high-value collections, museums, or by specialty insurers. You’ll need to prove the original’s uniqueness and provide documentation like certificates of authenticity and provenance records.

How These Methods Compare

Here’s how the three methods stack up in real-world scenarios:

| Method | Typical Use | Value Range | Pros | Cons |

|---|---|---|---|---|

| FMV (Fair Market Value) | Standard policies | Based on auction or recent sales | Objective, data-driven, widely accepted | May be lower than replacement cost; hard to determine for rare pieces |

| Retail Value | Galleries, emerging artists | Usually 20-50% higher than FMV | Reflects current market availability | Can be inflated or unstable; depends on gallery pricing |

| Replacement Cost | High-value collections, specialty insurers | Often exceeds FMV by 50-100% | Best for irreplaceable pieces; covers actual need | Expensive premiums; requires detailed documentation |

Most standard art insurance policies default to FMV. If you want more coverage, you have to ask for it. Retail value is often used as a middle ground-especially for modern and contemporary art where auction records are sparse. Replacement cost is the gold standard, but it’s not something you get automatically.

Why Appraisals Matter

Insurance companies don’t just take your word for it. They require a professional appraisal from a certified art appraiser-someone with credentials from organizations like the Appraisers Association of America or the International Society of Appraisers.

Appraisals should include:

- High-resolution photos of the artwork

- Artist’s name, title, date, medium, dimensions

- Provenance history (who owned it before)

- Condition report

- Valuation method used (FMV, retail, or replacement)

- Expiration date (usually valid for 2-3 years)

If you don’t have a current appraisal, your claim might be denied-or worse, paid out at a fraction of what you expected. One collector in New York lost over $40,000 in coverage because her appraisal was five years old and the artist’s market had exploded since then.

What Happens When Art Is Damaged or Lost?

When you file a claim, your insurer will look at:

- Your policy terms

- Your most recent appraisal

- The method they use to value art

- Whether the piece is replaceable

If your policy says “replacement cost” but the insurer claims the piece isn’t replaceable, they might offer FMV instead. That’s when you need documentation: auction results, gallery receipts, emails from the artist, even social media posts showing similar works selling.

Some insurers now use digital art registries like Artory or Verisart to track ownership and provenance. If your piece is registered there, your claim moves faster and with more credibility.

What Most People Get Wrong

Many collectors assume their home insurance covers their art. It doesn’t-not really. Standard policies usually cap art coverage at $1,500-$2,500. Anything above that needs a separate rider or floater policy.

Another mistake? Assuming value doesn’t change. Art markets shift. A piece that was worth $10,000 in 2022 could be worth $25,000 in 2025-or drop to $6,000 if the artist falls out of favor. Update your appraisal every two years. Don’t wait until something happens.

And never use online valuation tools. Sites that say “your painting is worth $8,000 based on 3 similar images” are useless. They don’t know provenance, condition, or market demand. Only a certified appraiser can give you a reliable number.

How to Choose the Right Policy

Ask your insurer these questions:

- Which valuation method do you use by default?

- Can I choose replacement cost?

- How often do I need to update my appraisal?

- Do you accept appraisals from certified professionals?

- Do you work with art recovery specialists?

If you’re serious about your collection, go with a specialist insurer-like Chubb, Hiscox, or AIG’s fine art division. They know how to handle high-value art, and they’ll guide you through the appraisal process.

Final Thoughts

Art isn’t just decoration. It’s an asset. And like any asset, it needs protection that matches its real value-not what you paid for it, not what a gallery says it’s worth, and not what an algorithm guesses. FMV, retail value, and replacement cost aren’t just terms. They’re your insurance lifelines. Know which one you have. Know what it covers. And don’t wait until it’s too late to find out.

Is FMV the same as auction price?

Not always. Auction price is one way to determine FMV, but FMV considers the broader market-including private sales, gallery transactions, and condition. A piece might sell for $120,000 at auction due to bidding wars, but its FMV could be lower if similar pieces regularly sell for $80,000 in private deals.

Can I use my tax appraisal for insurance?

No. Tax appraisals are for estate or donation purposes and often use different standards (like fair market value for charitable gifts). Insurance companies require appraisals specifically written for insurance coverage, with clear methodology and expiration dates.

Do I need insurance if my art is insured by the gallery?

Gallery insurance only covers the gallery’s liability-it doesn’t protect your ownership. If the artwork is damaged while in their care, you might get reimbursed, but only up to their policy limits. You still need your own policy to cover theft, fire, or damage while in your home.

What if my art is stolen and never recovered?

If you have a replacement cost policy, you’ll likely get paid based on the cost to replace it. With FMV, you get what the market says it’s worth today. Some policies also cover “replacement with similar art” if the original is unique and cannot be replaced exactly.

How long does an art appraisal last?

Most insurers require appraisals to be updated every two years. Art markets change fast. A piece that was worth $50,000 in 2024 could be worth $75,000 in 2026-or drop to $30,000. Outdated appraisals can lead to underinsurance or claim denials.