Legal Compliance Calendar for Gallery Managers: Key Dates and Deadlines for 2026

Running a gallery isn’t just about hanging art and hosting openings. If you’re managing a gallery in 2026, you’re also juggling a growing list of legal obligations that can land you in trouble if missed. One missed filing, one unreported sale, one improperly stored artwork - and suddenly you’re facing fines, audits, or even a shutdown. This isn’t scare tactics. It’s reality. And the only way to stay ahead is with a clear, practical compliance calendar.

Why Gallery Legal Compliance Can’t Wait

Art galleries operate in a legal gray zone. They’re not just retailers. They’re curators, custodians, and sometimes de facto insurers of high-value cultural assets. That means they’re subject to rules from multiple agencies: tax authorities, cultural heritage bodies, customs officials, and even local zoning boards.

A gallery in Portland got hit with a $12,000 penalty last year because it didn’t file Form 1099 for an artist who sold $6,500 in work through a consignment. Another gallery in Chicago lost its permit after storing unregistered artifacts in a climate-controlled basement without proper documentation. These aren’t rare cases. They’re becoming more common as enforcement tightens.

Compliance isn’t optional. It’s part of your operational backbone - just like inventory tracking or marketing. And like any system, it needs scheduled checkups.

Monthly Compliance Tasks

Every month, your gallery should handle these three non-negotiable items:

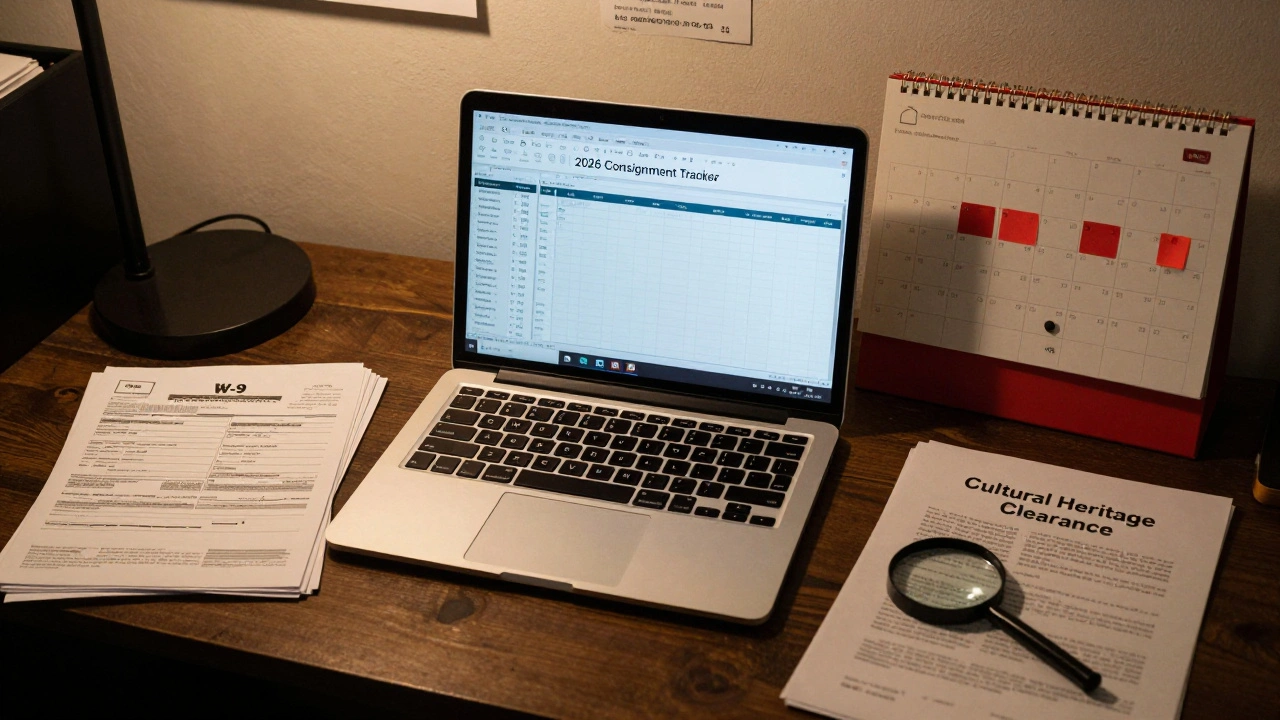

- Record all sales and consignments. Whether you sold a painting outright or held it on consignment, document the buyer, artist, price, and date. Use a simple spreadsheet or gallery management software - but don’t rely on memory. The IRS and state revenue departments audit galleries for unreported income.

- Update artist contracts. If an artist hasn’t signed a new consignment agreement in over 12 months, revisit it. Terms on commissions, insurance, return policies, and reproduction rights change. Outdated contracts expose you to lawsuits.

- Check storage conditions. Artworks degrade if humidity, temperature, or light levels aren’t monitored. Keep logs. If you store anything valued over $5,000, you’re required by most insurance policies to maintain written climate records. Failure to do so voids coverage.

Set a recurring calendar event for the 5th of every month. Block out two hours. Treat it like a staff meeting. No exceptions.

Quarterly Deadlines You Can’t Ignore

Every three months, your gallery must complete these critical filings:

- State sales tax filings. If you’re selling art in a state with sales tax (that’s 45 of them), you must file quarterly. Even if you had no sales, you still need to file a zero return. Missing this triggers automatic penalties - often $250 per quarter, plus interest. Don’t wait for a notice. Mark your calendar.

- Artist 1099s preparation. If you paid any artist $600 or more in a calendar year (including commissions, fees, or rental payments), you must issue a Form 1099-NEC by January 31. But you need to gather the data by March 31 to ensure accuracy. Start collecting W-9 forms from every artist you work with - no exceptions.

- Insurance policy review. Your gallery insurance should be reviewed every quarter. Has your collection value increased? Did you add new storage? Did you host an event? Adjust your coverage. Underinsuring art is like driving without brakes.

Mark March 31, June 30, September 30, and December 31 on your calendar. Set a reminder 10 days before each date. These are your quarterly checkpoints.

Annual Legal Requirements

These are the big ones - the ones that can shut you down if missed.

- Business license renewal. Most cities require galleries to renew their business license annually. Portland’s deadline is April 1. Miss it and you’ll pay a 25% late fee. Other cities like San Francisco and New York have stricter rules - some require reapplication if you change your space or add new services.

- IRS Form 990 (if you’re a nonprofit). If your gallery is registered as a 501(c)(3), you must file Form 990 by May 15. Failing to file for three straight years means automatic loss of tax-exempt status. That’s not just a tax issue - it’s a credibility killer. Don’t assume your accountant is handling it. Confirm it yourself.

- Artwork provenance documentation. If you handle any artwork that may have been looted, stolen, or imported illegally, you must maintain provenance records for at least seven years. The U.S. Customs and Border Protection and the Department of Justice are cracking down on unverified imports. If you bought a piece from a dealer in Paris in 2023, you need the invoice, export certificate, and any cultural heritage clearance paperwork.

- Accessibility compliance (ADA). If your gallery is open to the public, it must comply with the Americans with Disabilities Act. This means accessible entrances, restrooms, and exhibition paths. In 2025, the DOJ issued new guidance requiring galleries to provide audio descriptions for at least 20% of exhibited works. Start planning for 2026 compliance now.

Special Considerations: International Art and Cultural Heritage

If your gallery imports or exports art, you’re under extra scrutiny.

Since 2024, the U.S. has enforced stricter rules under the Cultural Property Implementation Act. Any artwork over 100 years old that was exported from a country with a bilateral agreement (like Italy, Mexico, or Cambodia) requires a CITES or cultural heritage clearance. You can’t just rely on a seller’s word. You need official documentation.

Example: A gallery in Miami imported a 1920s Mayan sculpture from a private collector. No paperwork. Customs seized it. The gallery lost $48,000 and faced a federal investigation. Don’t let that be you.

Always ask: Where did this come from? Is there an export certificate? Is it listed in UNESCO’s database? If the answer is “I don’t know,” you’re already at risk.

Tools to Keep You on Track

You don’t need a legal team. But you do need systems.

- GalleryManager Pro - Tracks consignments, sales, and auto-generates tax reports.

- ArtLaw Tracker - Sends alerts for state tax deadlines and cultural heritage restrictions.

- Google Calendar + Shared Team Access - Simple, but effective. Create a shared calendar with color-coded events: red for taxes, blue for insurance, green for documentation.

Set up automated reminders. Sync them with your phone. Share them with your accountant. Make compliance a team sport.

What Happens If You Skip Something?

Let’s say you forgot to file your state sales tax return for Q1 2026.

Here’s what happens next:

- Day 1: You get a notice in the mail.

- Day 7: Penalty applied - 5% of unpaid tax, plus 0.5% per month.

- Day 30: Interest starts accruing.

- Day 60: The state may freeze your business bank account.

- Day 90: Your business license is suspended.

It doesn’t take long to go from "I’ll do it later" to "I’m out of business."

Same goes for missing artist 1099s. The IRS doesn’t care if you "didn’t know." They care that you didn’t file. And they cross-reference with artist tax returns. If your artist reports $8,000 in income from your gallery and you didn’t report it? You’re on their radar.

Start Now - Don’t Wait for a Notice

February 2026 is the perfect time to build your compliance calendar. Take out your phone. Open your calendar app. Block out the next 12 months.

Here’s your starter list:

- February 28 - Gather W-9s from all artists paid in 2025

- March 31 - Finalize 1099-NEC data

- April 1 - Renew Portland business license (or your city’s deadline)

- April 15 - File federal income tax (if you’re an LLC or sole proprietor)

- May 15 - File Form 990 (if nonprofit)

- June 30 - Review insurance policy

- July 31 - File Q2 sales tax

- September 30 - Check storage logs

- October 31 - File Q3 sales tax

- December 31 - Finalize 2026 consignment records

- January 31, 2027 - Issue 1099s to artists

Print it. Tape it to your wall. Share it with your team. Compliance isn’t a chore. It’s your shield. And in 2026, it’s the difference between thriving and barely surviving.

Do I need to file taxes if I only sell art on consignment?

Yes. Even if you don’t own the artwork, you’re still the seller of record in most states. You collect the money, then pay the artist. That means you’re responsible for collecting and remitting sales tax. You also must report your commission income as revenue. The IRS treats gallery commissions as business income. Keep detailed records of each sale, the artist’s share, and your cut.

What if I don’t have a physical storefront?

You still need a business license and must comply with tax laws. Many states now require online art sellers to register as remote sellers if they exceed $100,000 in annual sales or 200 transactions. Even if you only host pop-up shows or sell via Instagram, you’re subject to the same rules as a brick-and-mortar gallery. Check your state’s economic nexus rules.

Can I use my personal bank account for gallery sales?

Technically, yes - but don’t. Mixing personal and business funds makes audits inevitable. Banks flag unusual activity. The IRS sees commingled accounts as a red flag for tax evasion. Open a separate business checking account. Even if you’re a sole proprietor, this simple step protects you legally and makes accounting 10x easier.

Do I need insurance for every artwork I display?

Not every single piece, but you must have a blanket policy covering all items in your care. Most insurers require you to list all artworks valued over $5,000. For lower-value pieces, you can use a "total value" policy. But if you don’t have coverage and something is damaged or stolen, you’re personally liable - even if the artist owned it. Always ask your insurer for a gallery-specific policy. Standard business insurance won’t cut it.

What documents should I keep for provenance?

For any artwork over 100 years old or from a country with cultural heritage protections (Italy, Mexico, Egypt, Cambodia, etc.), keep: the original invoice, export license, import declaration, and any certification from the country of origin. If you bought it from a dealer, get a signed statement of provenance. Store these digitally and physically. The Department of Justice can request them years later - especially if the artwork is later claimed by a foreign government.